Relief for salaried class and industry termed a turning point

Shift of policy role to finance ministry will boost confidence.

Staff Report

ISLAMABAD: The business community has responded with optimism to the government’s decision to strip the Federal Board of Revenue of its tax policy formulation powers, with industry leaders describing the move as a pivotal reform that could reshape the country’s economic trajectory.

The transfer of policy responsibilities to the Ministry of Finance represents a fundamental shift from revenue-driven taxation toward growth-oriented fiscal planning, according to prominent business figures who have long advocated for such structural changes.

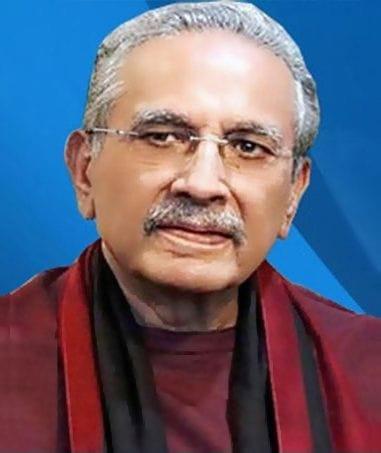

Former Islamabad Chamber of Commerce and Industry president Shahid Rasheed Butt characterised the reform as addressing decades of policy inconsistency that had deterred both domestic and international investment.

“Pakistan’s economy has repeatedly suffered because collection targets rather than growth incentives drove tax policy,” he observed, emphasising that the new arrangement would provide much-needed clarity for investors. The business leader highlighted the finance minister’s commitment to designing the next budget on principles of economic value creation, describing this approach as essential for developing a fairer and more sustainable tax base.

Shahid Rasheed Butt argued that the shift would help Pakistan move away from ad hoc policy adjustments. The proposed relief measures for the corporate sector and salaried class have drawn particular praise from industry representatives, who note that both groups have shouldered disproportionate tax burdens in recent years. Mr. Butt emphasized that reducing pressure on these segments would not only provide operational breathing space for businesses but also offer relief to the inflation-squeezed middle class.

“If the government follows through on this commitment, it will strengthen private-sector participation in economic recovery,” he stated, linking the tax reforms to broader economic stabilisation efforts. Current economic data support cautious optimism about Pakistan’s recovery trajectory. GDP growth has reached 2.7 per cent this year, while the country has achieved a current account surplus of nearly $2 billion and witnessed inflation decline significantly.

However, Mr. Butt cautioned that savings and investment ratios remain among the region’s lowest, creating vulnerability that could undermine growth sustainability without targeted reforms and stronger domestic resource mobilisation. The introduction of QR codes on utility bills to promote digital payments has been welcomed as a complementary reform that could help modernise Pakistan’s economy and reduce cash transactions. This digital push aligns with broader efforts to enhance financial transparency and tax compliance.

Despite welcoming the policy direction, business leaders stress that structural reforms, including FBR reorganisation and pension fund restructuring, must proceed without delay to prevent gains from remaining temporary. The complexity of these institutional changes will require sustained political commitment. Shahid Rasheed Butt acknowledged that meaningful benefits from these reforms would likely take years to reach ordinary citizens. Still, he emphasized that Pakistan’s movement from near-bankruptcy to cautious recovery represents significant progress and continuity of reforms would be critical for consolidating this momentum.

The business leader also highlighted climate change and rapid population growth as existential challenges requiring enhanced private sector engagement alongside government policy efforts.

The policy reforms are expected to boost market confidence by providing clearer regulatory frameworks and reducing uncertainty. Foreign investor interest could increase if implementation of these structural changes continues, he said.