NEPRA’s decision to reduce the buyback rate to damage solar industry.

TARIQ KHATTAK

Islamabad

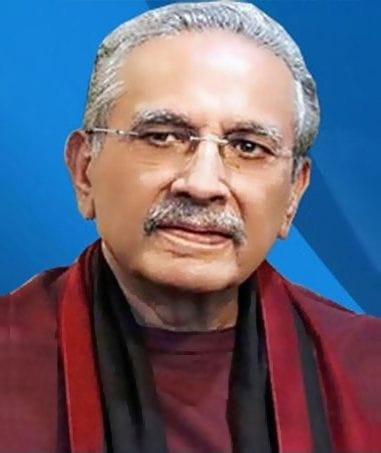

Shahid Rasheed Butt, a noted business leader and former president of the Islamabad Chamber of Commerce, said on Friday that the Prosumer Regulations 2025, which cut solar buyback rates from about Rs 26 per unit to Rs 13 per unit and limit system capacity to the approved load, could hurt Pakistan’s shift to renewable energy and affect its climate commitments under international agreements.

The revised regulations would reduce the maximum permitted solar system size from 150 percent to 100 percent of the approved load, shorten contract durations from seven to five years, and replace net metering with net billing. These measures are fundamentally inequitable, as distribution companies are permitted to sell electricity at rates as high as Rs 60 per unit while purchasing solar-generated power at a fraction of that price.

Shahid Rasheed Butt said these changes would effectively double the payback period for a standard 10-kilowatt solar installation, extending it well beyond the global benchmark of five years. Such a shift could result in the loss of over 45,000 jobs across installation, maintenance, and manufacturing, designed to protect the revenues of power utilities now facing reduced demand as on-grid solar capacity has surpassed 6,000 megawatts.

The business leader further argued that the shift to net billing introduces a pronounced disparity between the compensation offered for solar power and the rates charged to consumers, effectively imposing a solar tax. He criticized the policy as lacking foresight, warning that it could force Pakistan to remain dependent on costly, long-term, and polluting energy sources. He also highlighted that the expansion of solar energy has already reduced the nation’s annual fuel import bill. According to World Bank projections, the sector could create over 200,000 jobs by 2030.

A 20 percent decline in demand for grid electricity has left several major fossil-fuel power plants operating below capacity and the financial obligations associated with these plants remain unchanged, placing additional strain on the energy sector. These agreements were not made by the public, so why are they being punished for them, he questioned.